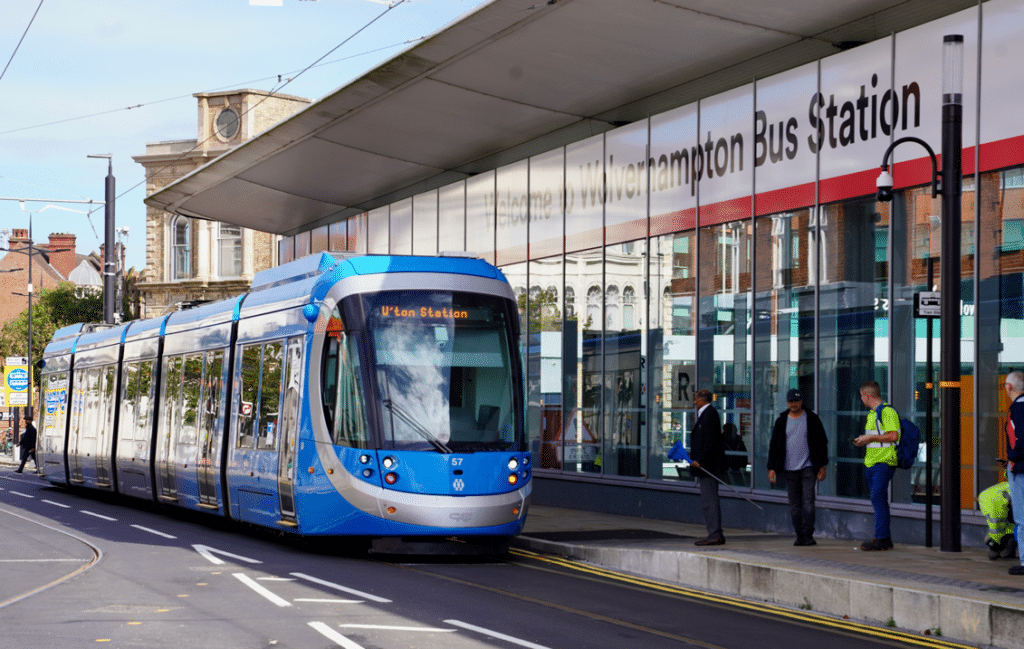

AMSCI recycled -

Advanced Manufacturing Supply Chain Initiative recycled

Debt finance - investment typically from £1million to £2million

Are you a advanced manufacturing supply chain provider? Or a manufacturing SME innovator? The recycled AMSCI (Advanced Manufacturing Supply Chain Initiative) is a fund for businesses seeking investment to increase their growth potential.

It as been designed to support your aspirations to use automation, computation and software to create greater efficiencies within your business and position your company as a key supplier to OEM/Tier 1 manufacturing companies.

AMSCI recycled is a loan investment fund to help address market failures and increase business capabilities and competitiveness.

Investment from: £1million to £2million

Location: England wide

Transaction: For project based costs

Sector: Any considered

Innovating and advancing the manufacturing industry

The AMSCI recycled fund offers tailored loans ranging from £1m to £2m, exclusively for England-based SMEs in the advanced manufacturing sector. These investments are designed to enhance business capabilities, increase competitiveness, and stimulate job creation while addressing crucial market gaps. To be eligible, businesses must demonstrate that their project would face significant delays or would not be feasible without this funding.

Eligible projects must be located within England and aim to create new jobs or safeguard existing ones. Possible projects include:

- Advancing product, material, or process innovations for production enhancements – making them lighter, stronger, faster, or better etc.

- Supporting the green economy through manufacturing initiatives that contribute to the transition to net zero.

- Digital manufacturing or high-tech growth that strengthens supply chains and fosters job creation or retention.

Explore how AMSCI can drive your manufacturing project forward. For more details on application and project eligibility, get in touch.

Apply here

Other SME Funding

What is the eligibility criteria?

- Available to established, profitable SMEs operating in the UK, working in any manufacturing sector.

- Every investment considered on a case-by-case basis, no stringent lending criteria.

- Businesses must be trading for at least 3 years.

- Terms and fees will apply.

What AMSCI recycled can support

- Establish new production lines

- Support project-related R&D costs for market-ready improvements

- Provide training linked to specific, ready-to-implement projects

- Working capital that is linked to a specific project

- Facilitate the fit-out of new manufacturing or R&D facilities

- Capital expenditures

- Provide gap funding and support for pre-profit phases

What the fund can't support

- Fulfil pure working capital needs without project linkage

- Fund training programs without direct manufacturing advancements

- Finance property acquisition and development

- Handle specific transactions like MBO/MBI or acquisitions

- Assist in turnaround or distressed situations

- Support pre-revenue or startup phases

- Consider applications from non-manufacturing sectors

Regional growth

Investing in across England

Investment Range: Tailored debt finance typically between £1million and £2million, but with capacity to co-invest alongside other funds such as the National Tooling Loan Fund.

Geographical Focus: AMSCI recycled can be utilised across the England.

Funding Inclusivity: Focusing on nurturing business diversity, equity, and inclusion (DEI), welcoming applications from all sectors, especially from underrepresented networks like female founders.

Looking for investment?

Download our investment info pack and subscribe

Unlocking your business' growth potential

FDC funds have been designed to accelerate business growth as an alternative to traditional bank lending. Whether you’re breaking new ground in high-tech industries, following a buy and build strategy within the manufacturing sector, leading advancements in life sciences, or restructuring your management team. Our focus is on established SMEs poised for further growth, from any sector, with a keen eye on businesses that are shaping their future.

Start the journey with FDC

We’re not just about funding; we’re about fostering growth, facilitating innovation, and supporting the aspirations of SMEs. If you’re ready to take your business to the next level, we’re here to help.

To begin, let’s start a conversation via our enquiry form and explore how we can work together. Following your enquiry, we will review your requirements and pass this information onto the relevant investment team who will be in touch to learn more about your business and goals.

Why choose FDC?

We are dedicated to empowering businesses with the debt investment they need to scale, innovate, and lead. Our mission is clear: to be at the forefront of debt financing to fuel the next stage of your business’ success story.

With a holistic approach to every deal, our team of experienced investment professional help you navigate the funding process and gain a deep understanding of your business to offer more than just money. We believe in building relationships, understanding your business’ unique journey, and providing tailored support that respects your vision and ambitions. Committed to nurturing growing businesses and fostering regional economic growth.