Regional Debt Fund (West Midlands)-

Debt finance for growth

Investment from £1million to £2million

Is your SME businesses seeking investment for growth? The Regional Debt Fund provides flexible debt funding to established mid-market SMEs operating in the West Midlands. Working at the forefront of debt funding, our experienced Investment Directors develop a deep understanding of your business to make a rounded decision. Each deal is then uniquely structured to suit both strategy and cash flow for the long-term.

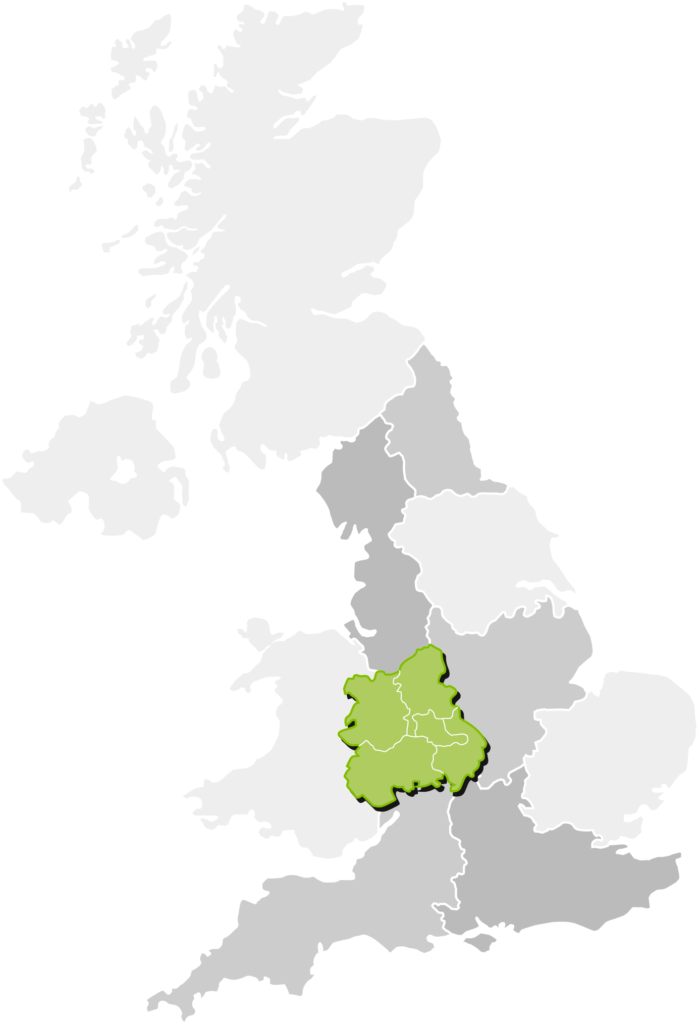

The West Midlands region includes Shropshire, Staffordshire, Herefordshire, Worcestershire and Warwickshire.

Investment from: £1million to £2million

Location: West Midlands region

Transaction: For accelerating growth and shareholder transactions

Sector: Any considered

Transforming the finance landscape

Are you a mid-market SME looking based in the UK looking for finance required to grow? If your business has been trading at profit for over three years, you can apply.

- Loan investment between £1million to £2million

- Can be utilised alongside other debt facilities

- For SME businesses able to demonstrate a track record of sustained profitability and growth

- Available as a genuine alternative to traditional lenders in terms of accessibility and flexibility

Targeting key business growth ambitions, get in touch for discuss your investment requirements. Investment can be used but not limited to:

Growth capital

Acquisition finance

Shareholder transactions incluing MBO, MBI, BIMBO

Apply here

Other SME Funding

What is the eligibility criteria?

- Available to established, profitable SMEs operating in the UK, working in any sector.

- Investment can be used for a broad range of purposes including shareholder transactions and growth capital.

- Every investment considered on a case-by-case basis, no stringent lending criteria.

- Flexible repayment structures of up to 5 years, designed to support both strategy and cash flow.

- Offering a genuine alternative to traditional lenders in terms of accessibility and flexibility.

- Experienced team ready to discuss a deal and navigate it through to completion.

- Businesses must be trading for at least 3 years.

- Terms and fees will apply.

Regional growth

Investing in across the UK

Investment Range: Tailored debt finance between £1million and £2million, but with capacity to co-invest alongside other funds and funders.

Geographical Focus: The Regional Debt Fund can only be utilised by West Midlands-based SMEs.

Funding Inclusivity: Focusing on nurturing business diversity, equity, and inclusion (DEI), welcoming applications from all sectors, especially from underrepresented networks like female founders.

Looking for investment?

Download our investment info pack and subscribe

Unlocking your business' growth potential

FDC funds have been designed to accelerate business growth as an alternative to traditional bank lending. Whether you’re breaking new ground in high-tech industries, following a buy and build strategy within the manufacturing sector, leading advancements in life sciences, or restructuring your management team. Our focus is on established SMEs poised for further growth, from any sector, with a keen eye on businesses that are shaping their future.

Start the journey with FDC

We’re not just about funding; we’re about fostering growth, facilitating innovation, and supporting the aspirations of SMEs. If you’re ready to take your business to the next level, we’re here to help.

To begin, let’s start a conversation via our enquiry form and explore how we can work together. Following your enquiry, we will review your requirements and pass this information onto the relevant investment team who will be in touch to learn more about your business and goals.

Why choose FDC?

We are dedicated to empowering businesses with the debt investment they need to scale, innovate, and lead. Our mission is clear: to be at the forefront of debt financing to fuel the next stage of your business’ success story.

With a holistic approach to every deal, our team of experienced investment professional help you navigate the funding process and gain a deep understanding of your business to offer more than just money. We believe in building relationships, understanding your business’ unique journey, and providing tailored support that respects your vision and ambitions. Committed to nurturing growing businesses and fostering regional economic growth.